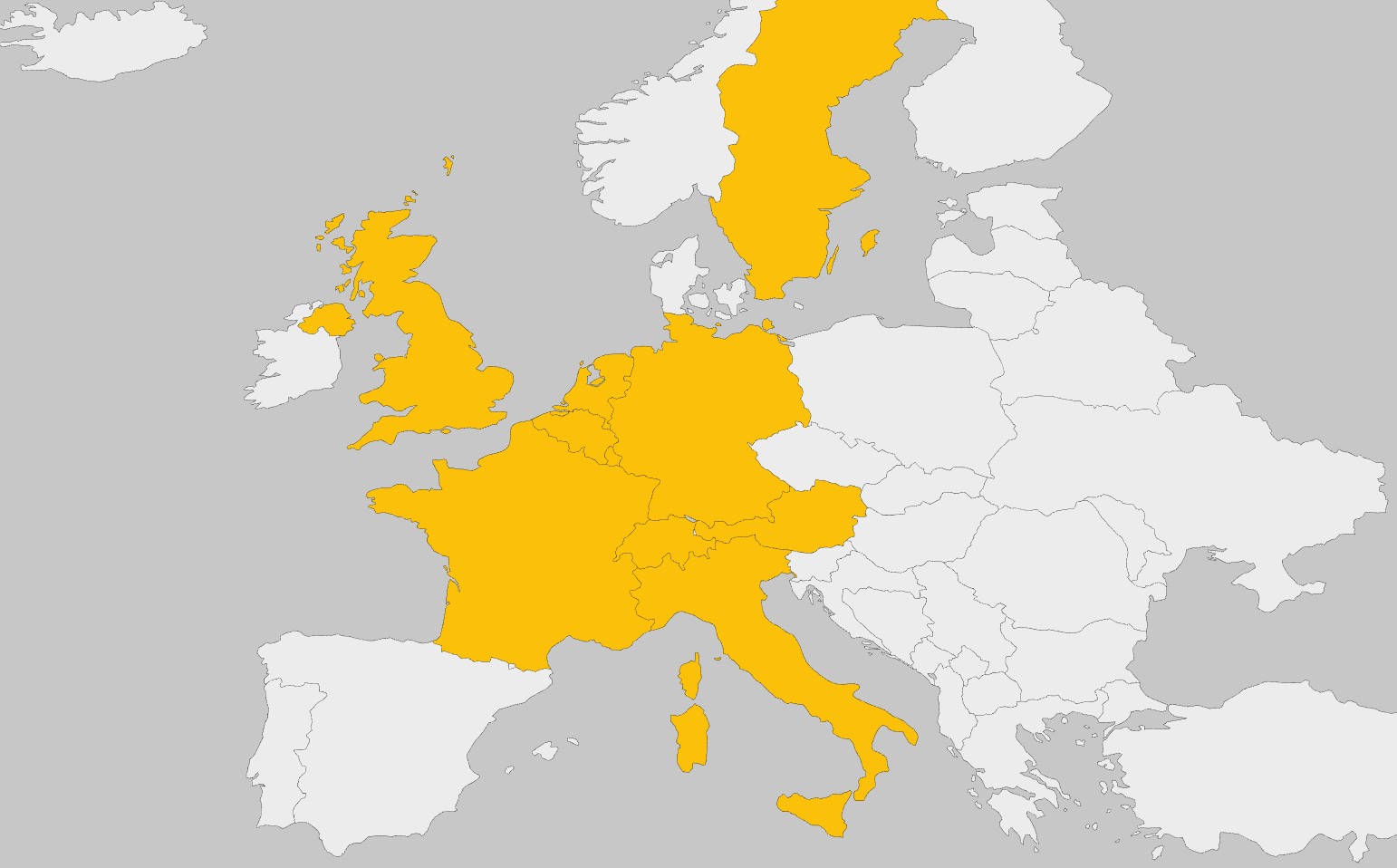

EUSIPA pursues, as umbrella association for issuers, the aim to coordinate transparency initiatives at the European level and to support uniform market standards. Through us many issuers engage in direct discussions with the decision-makers at European level.

Structured Products have become an established part of the retail financial products landscape. They offer, especially as certificate in a note-based format, many opportunities to the investor. Firstly, they open regional markets and asset classes that are difficult or impossible to access directly. Secondly, they offer returns also in markets moving side-wards or falling. Thirdly, they are highly liquid, meaning that they can be bought and sold within any time of the day.

To make national markets grow together to a cross-border level playing-field our members see the necessity of retaining attractive and fair framework conditions in Europe. Our members contribute for their part by adhering to a set of principles drawn up as self-regulatory framework for issuers, by promoting initiatives for uniform product classification such as the EUSIPA map and by enhancing product and market transparency on an overall basis.