EUSIPA seeks to contribute to the industry’s wider efforts of standardising certain elements of the market infrastructure. One of main achievements is the EUSIPA Products Map, a comprehensive product overview which displays the various common pay-out schemes according to their riskiness.

Governance

Supporting Partners

The following supporting market participants have agreed to integrate the EUSIPA categorization on their websites and other information material.

Associations

Exchanges & Dataproviders

Issuers

Categorisation

EUSIPA is initiator and main supporter of any efforts aiming for more transparency and understandability of the structured investment products features and role in portfolios. For this reason our members have agreed to set standards for a uniform categorisation of the structured product landscape.

11 CAPITAL PROTECTION

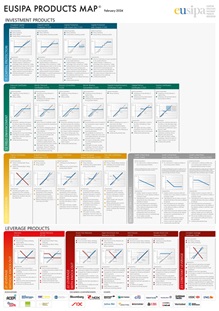

1140 Capital Protection with Coupon

Market Expectation

- Rising underlying

- Sharply falling underlying possible

Characteristics

- Minimum redemption at expiry equivalent to the capital protection

- Capital protection is defined as a percentage of the nominal (e.g. 100%)

- Capital protection refers to the nominal only, and not to the purchase price

- Value of the product may fall below its capital protection during the lifetime

- The coupon amount is dependent on the development of the underlying

- Any payouts attributable to the underlying are used in favour of the strategy

- Limited profit potential

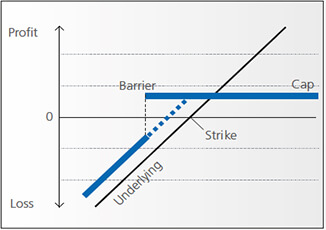

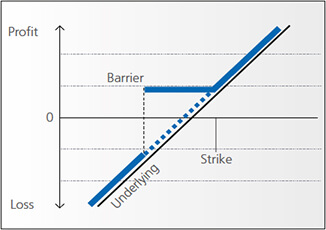

1130 Capital Protection with Knock-out

Market Expectation

- Rising underlying

- Sharply falling underlying possible

Characteristics

- Minimum redemption at expiry equivalent to the capital protection

- Capital protection is defined as a percentage of the nominal (e.g. 100%)

- Capital protection refers to the nominal only, and not to the purchase price

- Value of the product may fall below its capital protection during the lifetime

- Participation in a positive performance of the underlying until Knock-Out

- Possible payment of a Rebate following a Knock-Out

- Any payouts attributable to the underlying are used in favour of the strategy

- Limited profit potential

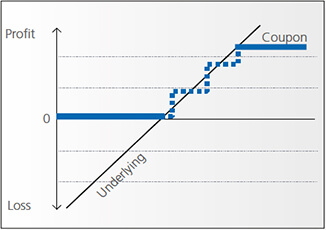

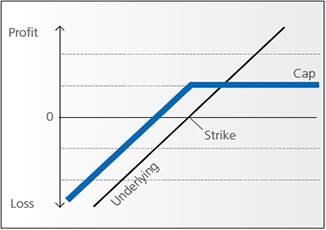

1120 Capped Capital Protected

Market Expectation

- Rising underlying

- Sharply falling underlying possible

Characteristics

- Minimum redemption at expiry equivalent to the capital protection

- Capital protection is defined as a percentage of the nominal (e.g. 100%)

- Capital protection refers to the nominal only, and not to the purchase price

- Value of the product may fall below its capital protection during the lifetime

- Participation in a positive performance of the underlying up to the Cap

- Any payouts attributable to the underlying are used in favour of the strategy

- Limited profit potential (Cap)

1110 Exchangeable Certificates

Market Expectation

- Rising volatility

- Sharply rising underlying

- Sharply falling underlying possible

Characteristics

- Minimum redemption at expiry equivalent to the capital protection

- Capital protection is defined as a percentage of the nominal (e.g. 100%)

- Capital protection refers to the nominal only, and not to the purchase price

- Value of the product may fall below its capital protection during the lifetime

- Unlimited participation in a positive performance of the underlying above the Strike (Conversion Price)

- Coupon payment possible

- Any payouts attributable to the underlying are used in favour of the strategy

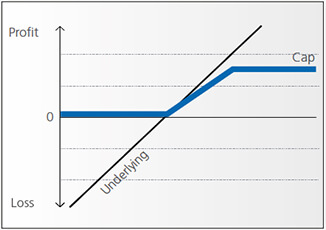

1100 Uncapped Capital Protection

Market Expectation

- Rising underlying

- Rising volatility

- Sharply falling underlying possible

Characteristics

- Minimum redemption at expiry equivalent to the capital protection

- Capital protection is defined as a percentage of the nominal (e.g. 100%)

- Capital protection refers to the nominal only, and not to the purchase price

- Unlimited participation in a positive performance of the underlying above the Strike (Conversion Price)

- Coupon payment possible

- Any payouts attributable to the underlying are used in favour of the strategy

12 YIELD ENHANCEMENT

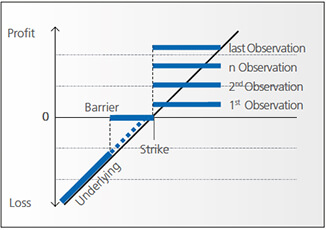

1260 Express Certificates

Market Expectation

- Underlying moving sideways or slightly rising

- Underlying will not breach Barrier during product lifetime

Characteristics

- Should the underlying trade above the Strike on the observation date, an early redemption consisting of nominal plus an additional coupon amount is paid

- Offers the possibility of an early redemption combined with an attractive yield opportunity

- Lower risk than a direct investment due to the conditional capital protection

- Larger coupon payments or lower barriers can be achieved at a greater risk if the product is based on multiple underlyings (multi-asset)

- Any payouts attributable to the underlying are used in favour of the strategy

- Limited profit potential

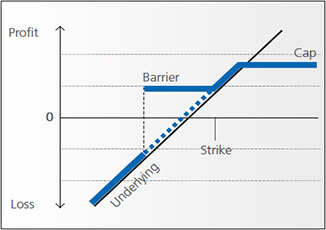

1250 Capped Bonus Certificates

Market Expectation

- Underlying moving sideways or slightly rising

- Underlying will not breach Barrier during product lifetime

Characteristics

- Minimum redemption is equal to the Strike if the Barrier is never breached

- Lower risk than a direct investment due to the conditional capital protection

- Larger Bonus payments or lower barriers can be achieved at a greater risk if the product is based on multiple underlyings (multi-asset)

- Any payouts attributable to the underlying are used in favour of the strategy

- Limited profit potential (Cap)

1240 Capped Outperformance Certificates

Market Expectation

- Rising underlying

Characteristics

- Reflects underlying price moves 1:1 when below the Strike

- Disproportional participation (Outperformance) in a positive performance of the underlying up to the Cap

- Risk comparable to a direct investment

- Any payouts attributable to the underlying are used in favour of the strategy

- Limited profit potential (Cap)

1240 Capped Outperformance Certificates

Market Expectation

- Underlying moving sideways or slightly rising

- Falling volatility

- Underlying will not breach Barrier during product lifetime

Characteristics

- Should the Barrier never be breached, the nominal plus coupon is paid at redemption

- A Barrier Reverse Convertible turns into a Reverse Convertible after breaching the barrier

- The probability of a maximum redemption is larger due to the conditional capital protection, the coupon achieved however is smaller

- The coupon is always paid, irrespective of the development of the underlying

- Lower risk than a direct investment due to the conditional capital protection

- Reduced loss potential compared to a direct investment

- Larger coupon payments or lower barriers can be achieved at a greater risk if the product is based on multiple underlyings (multi-asset)

- Any payouts attributable to the underlying are used in favour of the strategy

- Limited profit potential (Cap)

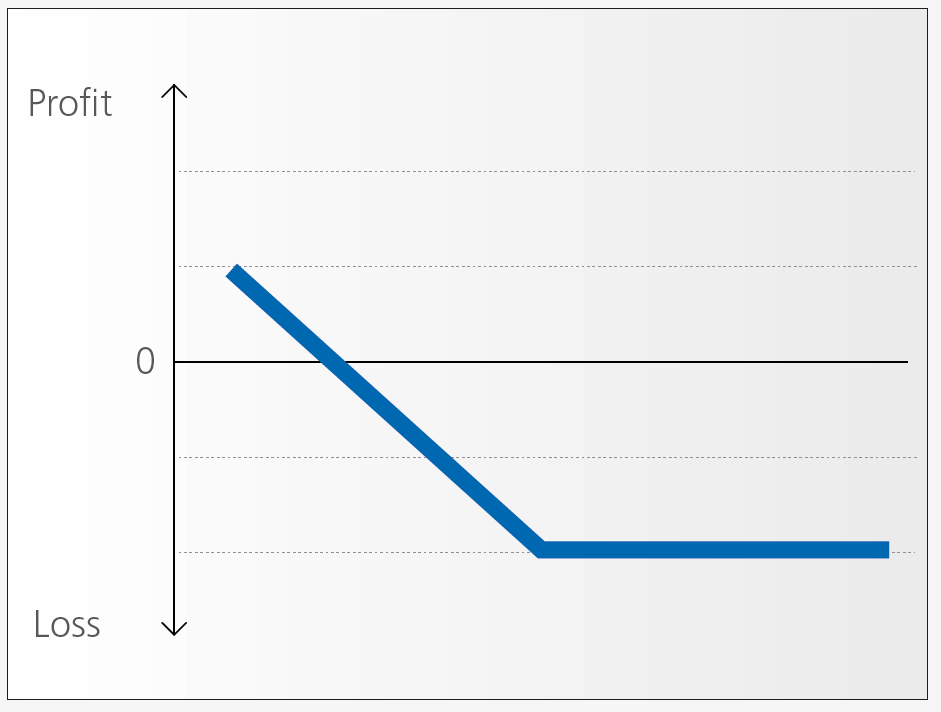

1220 Reverse Convertibles

Market Expectation

- Underlying trades sideways to slightly higher

- Falling volatility

Characteristics

- Should the underlying close below the Strike at expiry, the underlying and/or a cash amount is redeemed

- Should the underlying close above the Strike at expiry, the nominal plus the coupon is paid at redemption.

- The coupon is always paid, irrespective of the development of the underlying

- Reduced loss potential compared to a direct investment

- Larger coupons can be achieved at a greater risk if the product is based on multiple underlyings (multi-asset)

- Any payouts attributable to the underlying are used in favour of the strategy

- Limited profit potential (Cap)

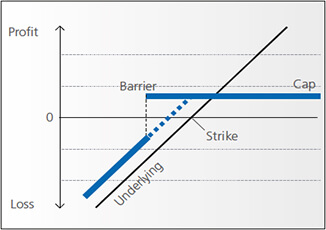

1210 Barrier Discount

Market Expectation

- Underlying moving sideways or slightly rising

- Falling volatility

- Underlying will not breach Barrier during product lifetime

Characteristics

- Barrier Discount Certificates enable investors to acquire the underlying at a lower price.

- The maximum redemption amount (Cap) is payed out if the Barrier is never breached.

- A Barrier Discount Certificate turns into a Discount Certificate after breaching the Barrier

- The probability of a maximum redemption is larger due to the conditional capital protection, the discount achieved however is smaller

- Lower risk than a direct investment due to the conditional capital protection

- Reduced loss potential compared to a direct investment

- Larger discounts or lower barriers can be achieved at a greater risk if the product is based on multiple underlyings (multi-asset)

- Any payouts attributable to the underlying are used in favour of the strategy

- Limited profit potential (Cap)

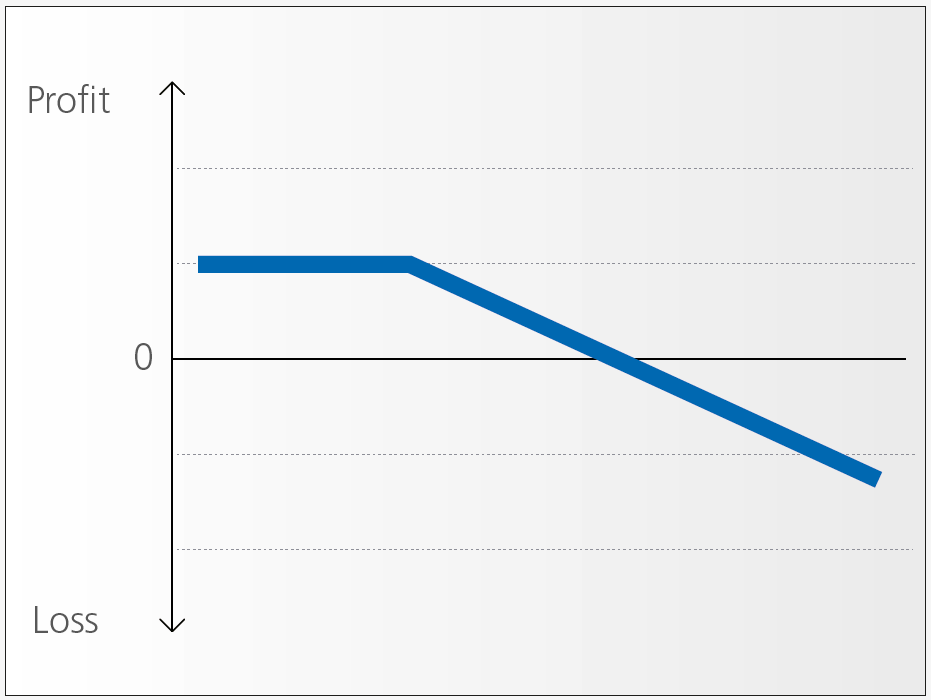

1200 Discount Certificates

Market Expectation

- Underlying moving sideways or slightly rising

- Falling volatility

Characteristics

- Should the underlying close below the Strike at expiry, the underlying and/or a cash amount is redeemed

- Discount Certificates enable investors to acquire the underlying at a lower price.

- Corresponds to a buy-write-strategy

- Reduced loss potential compared to a direct investment

- Larger discounts can be achieved at a greater risk if the product is based on multiple underlyings (multi-asset)

- Any payouts attributable to the underlying are used in favour of the strategy

- Limited profit potential (Cap)

13 PARTICIPATION

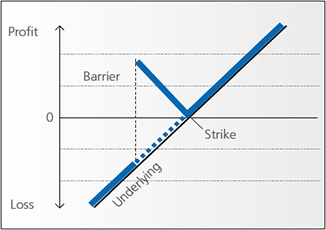

1340 Twin-Win Certificates

Market Expectation

- Rising or slightly falling underlying

- Underlying will not breach Barrier during product lifetime

Characteristics

- Unlimited participation in the development of the underlying

- Minimum redemption is equal to the Strike if the Barrier is never breached

- Profits possible with rising and falling underlying

- Falling underlying price converts into profit until the Barrier

- A Twin-Win Certificate turns into a Tracker Certificate after breaching the Barrier

- Any payouts attributable to the underlying are used in favour of the strategy

1330 Outperformance Bonus Certificates

Market Expectation

- Rising underlying

- Underlying will not breach Barrier during product lifetime

Characteristics

- Unlimited participation in the development of the underlying

- Minimum redemption is equal to the Strike if the Barrier is never breached

- Disproportional participation (Outperformance) in a positive performance of the underlying

- An Outperformance Bonus Certificate turns into an Outperformance Certificate after breaching the Barrier

- Lower risk than a direct investment due to the conditional capital protection

- Any payouts attributable to the underlying are used in favour ..of the strategy

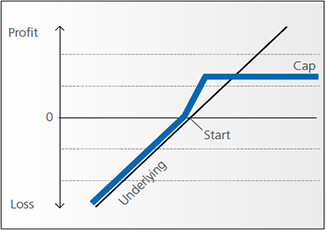

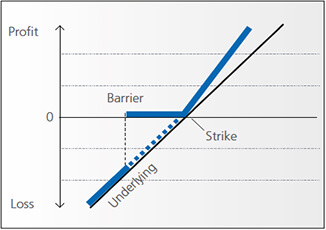

1320 Bonus Certificates

Market Expectation

- Underlying moving sideways or rising

- Underlying will not breach Barrier during product lifetime

Characteristics

- Unlimited participation in the development of the underlying

- A Bonus Certificate turns into a Tracker Certificate after breaching the Barrier

- Minimum redemption is equal to the Strike if the Barrier is never breached

- Lower risk than a direct investment due to the conditional capital protection

- Larger Bonus payments or lower barriers can be achieved at a greater risk if the product is based on multiple underlyings (multi-asset)

- Any payouts attributable to the underlying are used in favour of the strategy

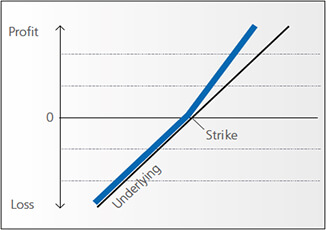

1310 Outperformance Certificates

Market Expectation

- Rising underlying

- Rising volatility

Characteristics

- Unlimited participation in the development of the underlying

- Disproportional participation (Outperformance) in a positive performance of the underlying

- Reflects underlying price moves 1:1 when below the Strike

- Risk comparable to a direct investment

- Any payouts attributable to the underlying are used in favour of the strategy

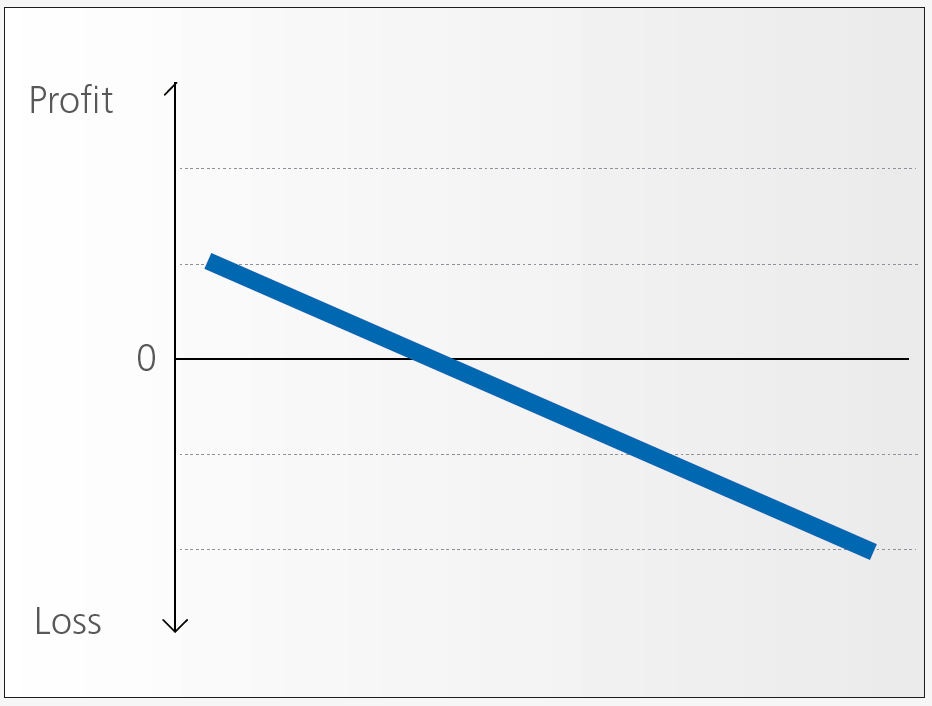

1300 Tracker Certificates

Market Expectation

- Tracker Certificate (Bull): Rising underlying

- Tracker Certificate (Bear): Falling underlying

Characteristics

- Unlimited participation in the development of the underlying

- Reflects underlying price moves 1:1 (adjusted by conversion ratio and any related fees)

- Risk comparable to a direct investment

- Fees generally in the form of management fees or through the retention of payouts attributable to the underlying during the lifetime of the product

14 CREDIT LINKED NOTES

Credit Linked Note Linear (1440)

Market Expectation

- No credit events in reference entities to occur during product lifetime

Investors are affected by the number of credit events on a linear basis subject to the rate of recovery

Characteristics

- Enables investors to assume credit risk towards one or more reference entities in exchange of yield

- Yield payments can be made as coupons during the life time of the note or collected at maturity

- Both yield payments and redemption amount are dependent on the abilities of the reference entity/entities to fulfil their obligations

- Credit events among the reference entity/entities reduce the yield and the

redemption amount; a potential total loss of capital is possible - Limited profit potential (Cap)

Credit Linked Note Equity Tranche (1450)

Market Expectation

- No credit events in reference entities to occur during product lifetime

Investors are affected by the number of credit events on a leveraged basis and total capital loss can therefore occur even if only part of the reference entities have suffered a credit event, subject to the rate of recovery.

Characteristics

- investors to assume credit risk towards one or more reference

entities in exchange of yield - Yield payments can be made as coupons during the life time of the

note or collected at maturity - Both yield payments and redemption amount are dependent on the abilities of the reference entities to fulfil their credit obligations

- Credit events among the reference entity/ entities reduce the yield and the redemption amount; a potential total loss of capital is possible

- Higher risk is achieved by increasing exposure towards the initial credit events in return for higher yield

- Limited profit potential (Cap)

Credit Linked Note Mezz./Senior Tranche (1460)

Market Expectation

- Credit events in reference entities may occur during product lifetime up to a specified treshold number of events.

Investors are protected from a certain amount of credit events in the reference entities and only affected after a certain threshold is breached. The exposure to credit events above such threshold or within such defined range, is leveraged.

Characteristics

- Enables investors to assume credit risk towards one or more reference entities in exchange of yield

- Yield payments can be made as coupons during the life time of the note or collected at maturity

- Both yield payments and redemption amount are dependent on the abilities of the reference entities to fulfil their credit obligations

- One or more credit events among the reference entities can occur before the yield and redemption amount is affected

- Risk can be modified by the exposure each credit event is allowed to have on the investment

- Limited profit potential (Cap)

LEVERAGE PRODUCTS

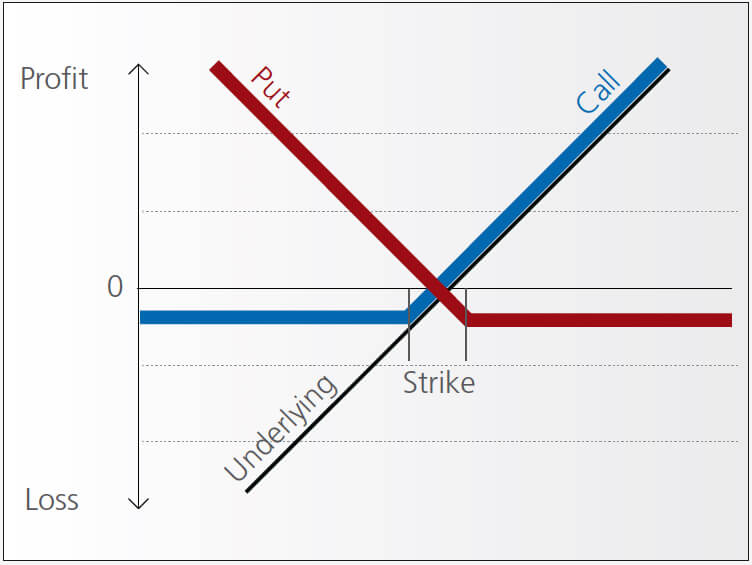

2100 Warrants

Market Expectation

- Warrant (Call): Rising underlying, rising volatility

- Warrant (Put): Falling underlying, rising volatility

Characteristics

- Small investment generating a leveraged performance relative to the underlying

- Increased risk of total loss (limited to initial investment)

- Suitable for short term speculation or hedging

- Daily loss of time value (increases as product expiry approaches)

- Continuous monitoring required

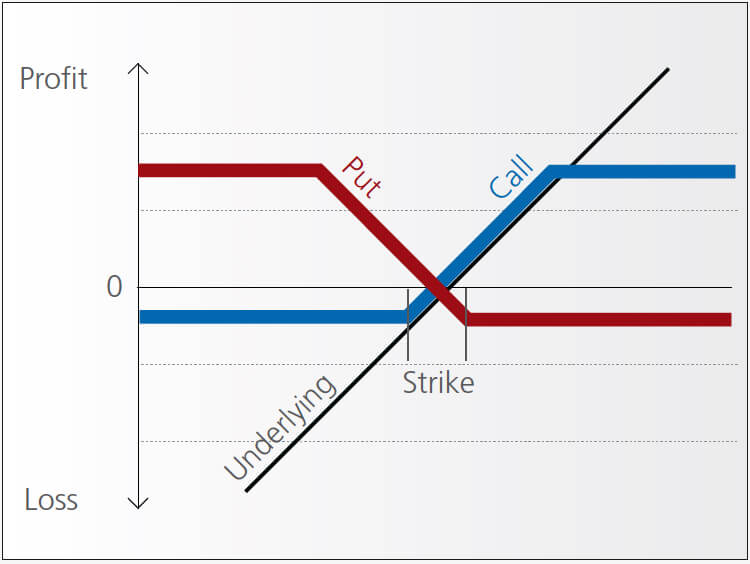

2110 Spread Warrants

Market Expectation

- Spread Warrant (Bull): Rising underlying

- Spread Warrant (Bear): Falling underlying

Characteristics

- Small investment generating a leveraged performance relative to the underlying

- Increased risk of total loss (limited to initial investment)

- Daily loss of time value (increases as product expiry approaches)

- Limited profit potential (Cap)

- Continuous monitoring required

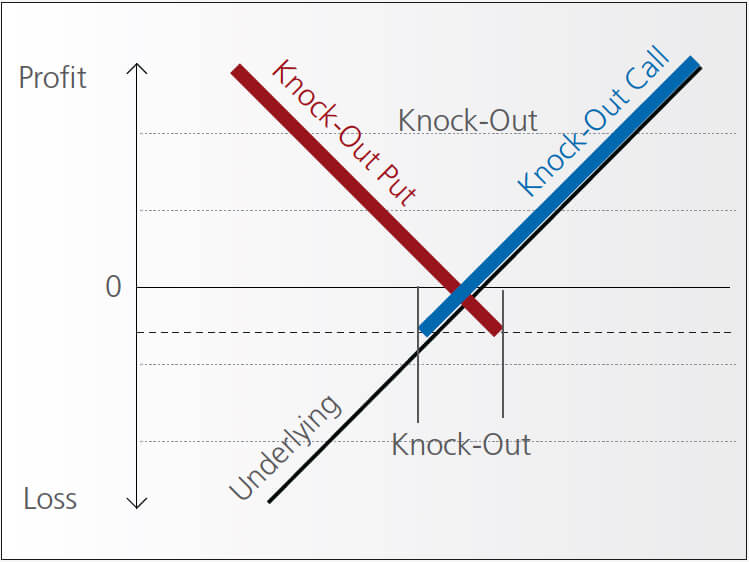

2200 Knock-Out Warrants

Market Expectation

- Knock-Out (Call): Rising underlying

- Knock-Out (Put): Falling underlying

Characteristics

- Small investment generating a leveraged performance relative to the underlying

- Increased risk of total loss (limited to initial investment)

- Immediately expires worthless in case the Barrier is breached during product lifetime

- Suitable for short term speculation or hedging

- Small influence of volatility and small loss of time-value

- Continuous monitoring required

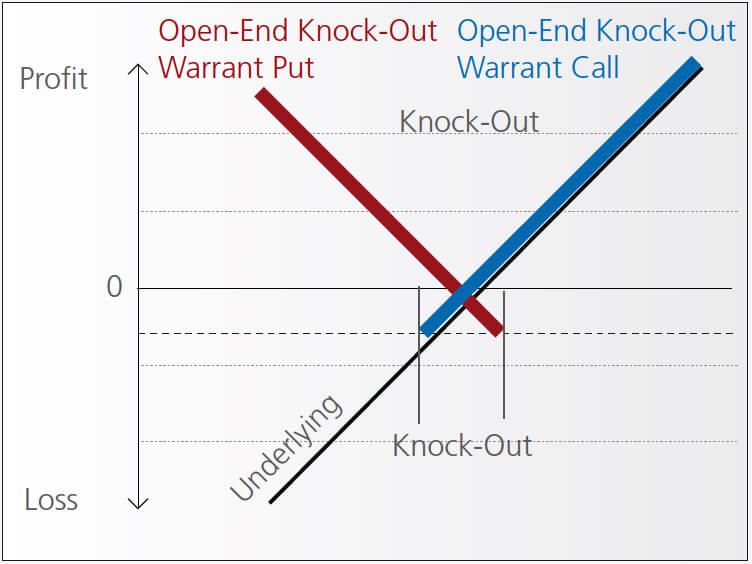

2205 Open-End Knock-Out Warrents

Market Expectation

- Open-End Knock-Out Warrants Call: rising underliying

- Open-End Knock-Out Warrants Put: falling underlying

Characteristics

- Small investment generating a leveraged performance relative to the underlying

- Increased risk of total loss (limited to initial investment)

- Immediately expires worthless in case the Barrier is breached

- Daily adjustment of the Barrier

- Open-End Maturity

- Suitable for short term speculation or hedging

- Small influence of volatility Continuous monitoring required

- Continuous monitoring required

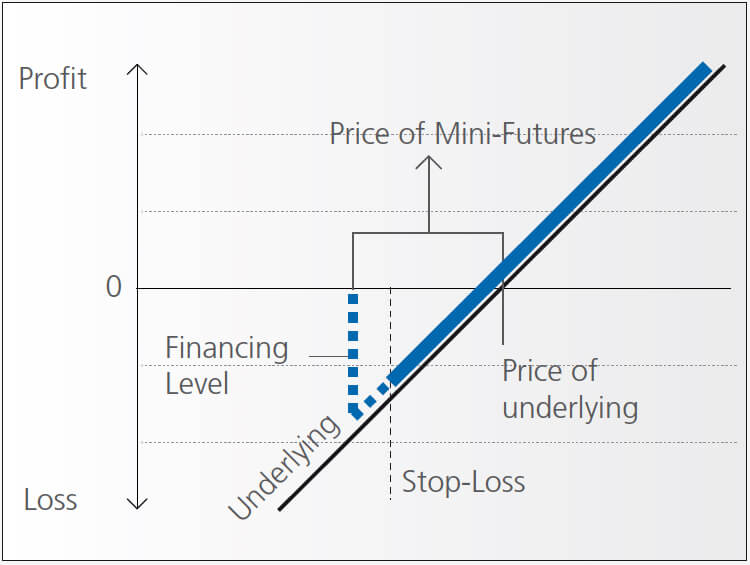

2210 Mini-Futures

Market Expectation

- Mini-Future (Long): Rising underlying

- Mini-Future (Short): Falling underlying

Characteristics

- Small investment generating a leveraged performance relative to the underlying

- Increased risk of total loss (limited to initial investment)

- Stop-Loss level differs from strike

- A residual value may be redeemed following a stop loss event

- Suitable for short term speculation or hedging

- No influence of volatility

- Continuous monitoring required

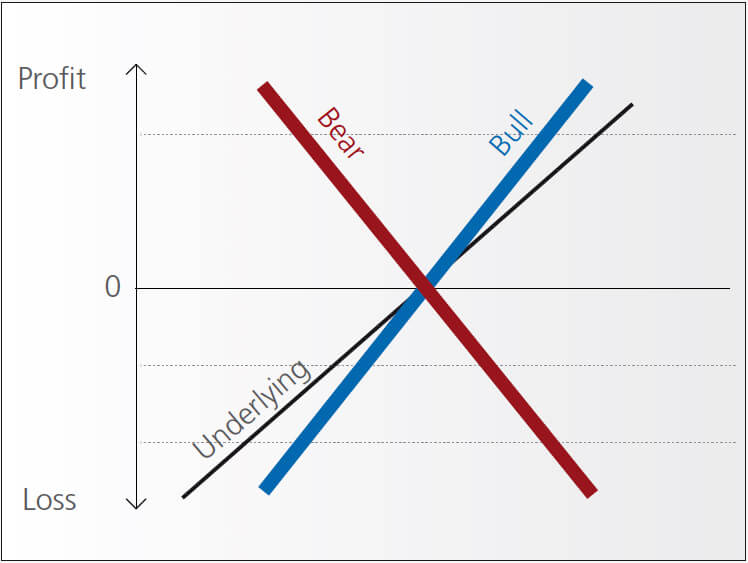

2300 Constant Leverage Certivicate

Market Expectation

- Bull: Rising underlying

- Bear: Falling underlying

Characteristics

- Small investment generating a leveraged performance relative to the underlying

- Increased risk of total loss (limited to initial investment)

- Suitable for short term speculation

- The leverage is constant for the defined period (e.g. daily) only

- Successions of price movements of the underlying in the same direction tend to have a positive effect on the performance, price movements of the underlying in opposite directions a negative effect

- A Stop Loss and/or an automatic reset feature prevent the value of the instrument to become negative

- Continuous monitoring required

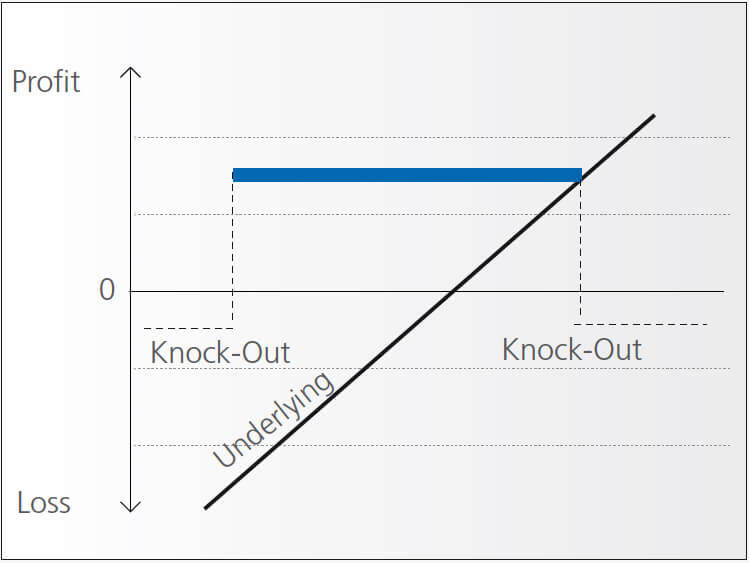

2230 Double Knock-Out Warrants

Market Expectation

- Underlying moving sideways

- Falling volatility

Characteristics

- Small investment generating a leveraged performance relative to the underlying

- Increased risk of total loss (limited to initial investment)

- Suitable for short term speculation Immediately expires worthless in case one of the barriers is breached during product lifetime

Limited profit potential (Cap) - Continuous monitoring required

Categorisation Committee

The Categorisation Committee is a technical working body of the association. Its members are senior technical experts delegated by national associations who bring in strong expertise and first-hand practical experience of the business. The Committee monitors and discusses mainly the evolution of the product landscape in the markets of our member associations. Following a defined procedure it suggests changes to the EUSIPA Map to the board.

Principles

It is our conviction that harmonisation of the EU internal markets should take place under a self-regulatory approach wherever possible. Therefore we have established a set of principles for the issuance and marketing of Structured Investment Products to retail investors in Europe. The aim of these principles is to make the governance standards in our business transparent for international investors and to give guidelines for the national associations.

Please click on the following link to access the document: